Investors love to compare their profession to a detective’s. You’re always on the lookout for the ‘right’ idea, you have to sort through all the clues, and you want just the facts, ma’am. In a world of people out for their own interest, you gotta dig to protect yours.

Nerdier investors will compare their efforts to a journalist’s. Digging through publicly available material, connecting the dots, and getting the story out that will change the world. Or at least your portfolio.

And it’s true. There’s a bit of digging that goes with investing. There’s a research element. And then there’s the logical piece, synthesizing the information and making your best decision from the facts.

We’ve talked about what sort of information you want when you are considering buying a stock. Its financials, its business model, its price and valuation, its prospects, and how it stacks up to competitors or the market, among other things. Now let’s talk about where to find this information. You don’t need to be Sherlock Holmes, and you don’t need to be Lois Lane. You just need to know where to look.

Let’s start with a review on how to use 10-Ks and 10-Qs.

What are 10-Ks and 10-Qs?

Every publicly traded company on the main exchanges is required to file a quarterly (form 10-Q) and annual report (form 10-K). There are time limits for when they can file them. You can expect them to be available either when a company reports earnings or in the week afterwards.

Why are quarterly and annual reports useful, and what can you expect from them?

There are a few reasons I prefer to go to the 10-K and 10-Q filings as a starting point for financial info.

It’s the purest form of the key numbers. Other company filings can adjust numbers in a legal but noisy way. Financial websites input/compile financials, but that also involves adjustments and form fitting. Meanwhile, annual reports are audited, and quarterly and annual reports have to follow strict regulations as far as telling the truth and what format it follows. It provides us apple to apples baseline numbers

The reports will also give you some color on what is happening to the company. There is some explanation of the numbers, in other words.

On the flipside, filings can be dry and dense. It can be intimidating to open up a 100+ page document and have to do anything with that information. And it’s written in legally polished, professionally appropriate language that makes it good bedtime reading for insomniacs.

Still, the annual and quarterly reports don’t have absolutely everything you need to understand a company, but they have a lot. And while they are dry, knowing how to use 10-Ks and 10-Qs to pull the information you want speeds up the process.

Where can you find the 10-Q or 10-K?

My favorite place to look is EDGAR, the electronic data gathering, analysis, and retrieval page. Google EDGAR and it should be the first or second result. If it’s not, add ‘filings’ to the search.

Click on that, and then click on company filings, and once more search by company or fund name. You’ll get a search box where you can enter a company or its ticker symbol to find its filings.

And when you enter, you should see 10-Qs and 10-Ks sorted out on the right.

EDGAR alternatives

That may seem like a lot of steps. There are other places that can simplify the process. Unfortunately, many of them cost money.

- Seeking Alpha offers all filings, though the UX isn’t great, and it costs $240/year.

- BAMSec is considered a top EDGAR alternative, but isn’t cheap – $828/year.

- Koyfin is a little cheaper at $420/year.

- Publicly traded companies usually have an investors relations website and often host most or all of their filings there for free. But you have to go to each company’s IR website to find them.

| Site | Cost | Comments |

| Seeking Alpha | $239/year | UX isn’t great |

| BAMSec | $828/year | Leader in filings |

| Koyfin | $420/year | Offers many other tools |

| Companies’ investor relations websites | Free | Have to go to each site individually |

I prefer EDGAR once you get used to it. Bookmark the company filings search page and then the rest gets easy. It has its clunky moments – it’s government software, ultimately – but I think it works well.

What are we looking for in 10-Qs and 10-Ks?

Let’s get to the meat. I’m going to use the 10-K first, and then will adapt that to a 10-Q.

I’ll use AirBnB as our example.

Item 1, the Business

Here, ABNB describes their business. We get a little bit of their story, what their focus is for growth, and how they describe their business and its challenges. Who is its competition, what key issues concern it, and so on. This should help you understand a company’s business model and what questions to ask.

After this comes the risk section. The risk section is an exercise in ass-covering. It is broad and tedious. A company wants to cover all potential bases so it can’t get sued for shares tanking due to an unforeseen issue.

That doesn’t mean it’s not useful. Scanning through the risks – each risk is bolded, and then explained in plain text – can often highlight something you should investigate further. Some of the risks are outdated or pro forma but some are worth looking at.

Item 5 – the market for the company’s shares

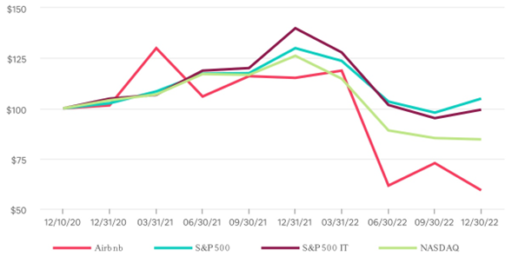

Item 5 will show whether the company has bought back any shares in the recent quarter. Then, more relevantly, it will show the company’s stock performance. The stock performance is useful just to see how the stock has performed; even if that performance might have been ‘wrong’, it matters. It’s also useful for finding what the company compares itself to.

Would you believe that AirBNB has been such an underperformer? Keep in mind that’s after it doubled on its first day as a public company. If you included its IPO price as the starting price, it would be outperforming.

We don’t learn a lot from their peer group, the S&P 500 IT, but with smaller companies this can be more helpful.

Item 7: management’s discussion and analysis

Here we will get a dry, useful explanation of how the company is doing, beyond what the numbers say. A company will explain why its gross margin went up or its operating margin went down from last year. It will often provide explanations for its adjusted metrics and how they compare to standard metrics. It will often share key metrics that are not classic financial metrics but that tell us a lot about the business – nights and experiences booked and gross booking value, in AirBNB’s case.

I usually come to this section if I already have a question I want to drill into – why did gross margin jump so much, or how did AirBNB do in North America vs. other areas, for example.

Item 8 – Financial statements

Our next stop on the journey is the meatiest. In item 8 or at the bottom of the annual report, you will find full-page tables that constitute the company’s financial statements.

The three statements we most care about are:

- the income statement – called consolidated statement of operations

- the balance sheet – consolidated balance sheet

- the cash flow statement – consolidated statement of cash flows

They usually appear in that order or with balance sheet first, and with two smaller statements coming before the cash flow statement*.

*Amazon famously puts the cash flow statement first, as a sign of their focus on cash flow.

We will write specific posts on how to analyze the financial statements. For now, know where they are.

One other thing to keep in mind is we want a shares outstanding number to be able to calculate the company’s valuation. While the income statement will usually have such a number, it will be the average number for the entire year or quarter. To get the most recent, scroll back to the top of the document, and you will find an outstanding shares number* as of the release or the report or shortly before.

*This will not include diluted shares.

Notes to Financial statements

This is the last useful stop on the annual report. It is something of a continuation of item 7 and item 8. If we want to see what AirBnB’s debt or cash and cash equivalents consist of, we can go to note 9 (debt) or note 4 (investments). Any detailed segment information the company discloses but wasn’t in the md&A will be here.

As a beginner I did not go down here very much, but it is worth being aware of it.

The 10-Q vs. the 10-K

The 10-Q is an abbreviated form of the 10-K. For starters, it focuses on the most recent quarter and only includes information on the year to date – 1-3 quarters instead of 4. But also, the format requires less disclosure. Risks are not usually included unless there’s something new. Stock performance is omitted. The form does not describe the business.

Instead, the 10-Q begins immediately with the same financial statements. The notes will usually be as detailed. And then the MD&A will usually follow the same format as the 10-K, but will be item 2, after the notes on the financials.

Most 10-Qs stop there as far as value-added information. If you know how to use 10-Ks, you should be fine using 10-Qs as well.

Which do I need to read first?

All things equal, the more you read about a company, the better. But our time is limited.

When I research a new company, I will look at the latest 10-Q to get a sense of the recent financial trajectory, and the current valuation. I will then spend more time on the 10-K and prior years 10-Ks understanding the business, how the company describes itself, what has changed about its story over time, and the longer-term financial picture. I will then return to 10-Qs if anything from a specific quarter stands out.

From there, there are a few other filings that are worth noting, but we’ll save those for their own post/video. And of course, there are some places to look for info beyond the filings.

That’s what we’ll get into next time – we’ll look at a more user-friendly, but also biased way to follow earnings reports. It’s essential to know how to use 10-Ks and 10-Qs, but the earnings reports can save us time and guide us through the denser reports.

3 responses to “How to Use 10-Ks and 10-Qs for Researching Stocks”

[…] time we talked about the 10-K and 10-Q, the official filings for annual and quarterly reports that tell us about a company’s business […]

[…] call transcripts to elevate your investing research. It is a nice complement to reading the 10-Ks and 10-Qs, and to reviewing earnings reports and […]

[…] far, we’ve talked about learning about stocks from quarterly earnings: the financial statements, the earnings presentations, or the earnings call transcripts. This sets a steady, structured, once […]