The list of things you can study about a company is not quite endless, but can run really long. You could visit its headquarters or factories, you could read about its history, you could study reviews of every product or service it provides. At some point, it gets to be too much. While we always want to keep an open mind and be learning, paralysis by analysis can be an expensive problem as well.

That said, there are a few things left that I think you should keep in mind before you make a buy. We want to evaluate a company’s management team, its recent history through its price chart, and the scuttlebutt around the company to fill out the story. These three items will help you get a better understanding of what you’re getting yourself into, without driving you insane.

Management

Good management can be all the difference between a mediocre investment and a winning one. It’s also really hard to tell, from the outside, whether a management team is good or not.

There are things we can look at to give us an idea of whether the management of the company is on our side and whether they do what they say they’ll do, two most valuable traits.

Management qualifications

We can look up their bio on the company website via google, and find out if the management team – especially the CEO, but for larger companies, other C-level officers too – have relevant and sufficient experience. Have they worked in other similar companies? If they were a CEO before, what’s the business track record and stock track record, either at another company or here? How long have they been in this company? Are they an insider that rose the ranks, or a hired target from the outside? Are they…family?

You may also want to dig around to see if there are any interviews or podcasts with the CEO or management team. This is a bit of a double-edged sword. On the one hand, you can get a sense of the person in charge and see how they think. On the other hand, a management team that is overly eager to be interviewed or to talk with people is a sign of, perhaps, inappropriate focus.

Management ownership stake

Then there’s how much of the company does management own? In general, the more a chunk of the business a CEO owns, the more they align themselves with shareholders. If the shares go higher, they do well, and so do shareholders. At some point CEO ownership can come with trade-offs – Mark Zuckerberg has such control over Meta Platforms that no one can get rid of him via a board vote. It’s good to know about this on either side, too much or too little. All things equal, a management team that has skin in the game is a good sign.

Management track record

A last thing is to see how good a job the management team does at delivering on results. Look up past presentations and see what the company’s strategies and projections were, and then what the reality was in the following years. Or go to the year-end report press release and earnings call transcript and see what management’s guidance for results was, and how well they met that guidance in the year ahead. Management teams that meet expectations, or even ones that under-promise and over-deliver, are ones that at least you can take seriously.

The chart – but not in that way

There’s a school of stock analysis called technical analysis. It primarily looks at patterns in a stock’s trading, and uses the repetition of those patterns to predict where a stock is going and make buy or sell calls accordingly.

There are people I respect who get some value out of technical analysis. But it has never made sense to me. Nothing I would be willing to put money into, let’s say.

So why am I telling you to look at the chart? Not to get a sense of the pattern, but to see what events have happened, and then to review what the big stories are.

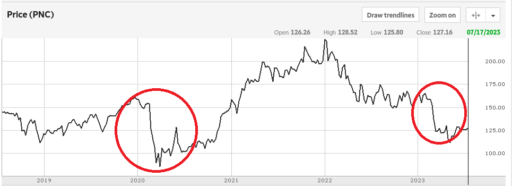

Let’s take PNC, a big bank, as one basic example. We can look at the 5-year chart and see two big drop-offs.

All charts courtesy of TD Ameritrade, circles are mine, and taken July 18th, 2023, before market open.

Looking at the X-axis, the first drop came during the initial pandemic market sell-off, and the second during the regional bank crisis of March 2023. The pandemic’s impact on a bank may be past us, but answering how PNC is dealing with challenges this year due to rising interest rates is a must before investing in shares.

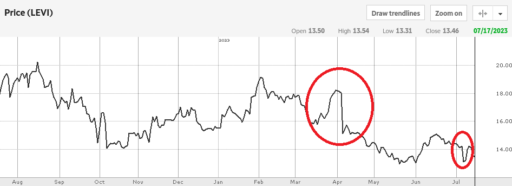

Another example: Levi Strauss, the famous jeans maker.

On a one-year chart, there are two meaningful drop-offs. The most recent one was earnings, which triggered me to use it as an example. I would assume the drop in April is earnings as well. We would take those as starting points to research what’s happening with Levi’s and whether the sell-offs are justified or overdone.

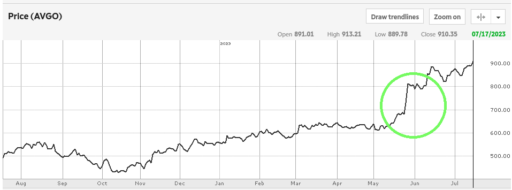

And let’s take a positive example – have a look at Broadcom’s chart.

Broadcom is one of the biggest semiconductor makers in the world. But what’s interesting, when you dig in, is nothing at Broadcom caused this price jump. Instead, this is the AI fueled bump from Nvidia’s report. Investors interested in Broadcom would want to figure out how relevant AI could be to Broadcom’s business.

The point of these charts is not to read tea leaves that will tell you the future. It’s to get an idea of where you might find news stories or headlines to watch out for about this company. Stocks will often move randomly or in the ‘wrong’ direction. Big jumps tend to be caused by something. If you understand what the causes are, you can be more prepared for owning the stock.

The scuttlebutt or the buzz

Scuttlebutt means the rumor or the gossip. It’s a naval term. It’s funny sounding, but a good way to represent all the information you might not find in the financials.

Finding out what the buzz is about your company can highlight questions to ask, issues the company might have, or what people really think about it.

You can do this by looking on financial sites to see what investors and analysts are saying about the company. This will be a little bit of tail wagging the dog, but is useful.

You can dig through the company’s LinkedIn page, or to Reddit forums, to see what competitors and anonymous employees are saying about the company, and whether the company is hiring aggressively.

GlassDoor has become an increasingly popular source for insight into a company’s culture. What do employees think about the CEO? What do the reviews say? There’s a lot of noise, but you can get some good info.

Local newspapers and trade publications may also shed light on how the company is viewed in its industry or region.

And one stat that is worth checking is the short interest. Short interest is the % of shares that have been sold short. Selling short is a way to bet against companies. If a lot of investors are betting against a company, that’s a bad sign. It means a lot of smart money thinks the stock is overvalued or the company is in trouble. But it’s also a cause of volatility if that crowd gets it wrong. We’re only talking about buying stocks, not shorting them. But I would be cautious about high short interest situations from either side of the aisle.

The learning never stops

The learning never stops when you own shares in a company. You should maintain an open mind, and keep looking for new information. This is both to support your holding shares and to try to disprove your position, to shake the foundation.

But you don’t want to try to take in every piece of information available on a stock before buying. Beyond anything else, you can’t take in every piece of information – there’s so much out there that is hard to hunt down. But also, you want to focus on what ultimately matters.

Evaluating the management team, the company’s price chart, and any scuttlebutt you can dig up could all turn up nothing. But, they are important elements that will often give you a fuller picture. Or even an extra reason to buy or not to buy shares. They’re worth checking into, before you make up your mind about a company.

Get our full list of posts on how to evaluate stocks here. Our next step? We’re explaining where you can find all this material. Starting with the financials themselves.

Disclosure: I have positions in VMWare (VMW), which is in the process of being bought out by Broadcom (AVGO), in part with AVGO shares, so I sort of have a position in it. PNC and LEVI’s are on my watchlist, and I may buy shares sometime in the future.