What to do before investing

You believe it’s time to invest. You want to put your money to better use. You’ve heard about the stock market and want to figure out how to get in on the action.

All of which is great, but are you ready to start investing? Let’s talk about the things you need to do before you start investing.

In this article, I want to share the pre-requisites to investing. These are the boxes you need to check off before you start your stock market journey. Checking off all of these does not mean you will have success investing. But if you don’t, you’re setting yourself up for failure.

Let’s get into the details:

Earn more than you spend

Think of investing in the stock market like a marathon: you want to go the distance. You want to stay in the race, and to do that you need to build up your endurance. Making sure your income is above your expenses is like making sure you’re healthy enough to walk three blocks. You need that base before you start putting in the 10-mile runs and scaling from there.

When you are not making enough money to pay for your expenses on a monthly basis, you are not going to be able to invest in your future. You first have to take care of the present.

Are you making more than you spend? To answer this question, look at your bank account and credit card statements and anywhere else money is coming in and out, and add all the debits and credits together and see where you end up. You want credits – the money coming into your bank account – to be more than debits – the money going out.

If the amount of money in your bank account is growing from a month to month basis, and it’s not because of something fluky like the stimulus checks or your 30th birthday special special present, that’s a good sign.

If you are spending more than you make, you need to either increase your income or reduce your expenses. That is not what A Short Investing Guide is about, but there are tons of resources out there on how to get your personal finances in order. Seek them out, and then come back here when you’re ready.

Subscribe to get the latest A Short Investing Guide posts:

And don’t try to hide your spending on your credit card statement, because to invest you have to…

Take care of high-interest debt

There are two fundamental principles of investing worth bringing up early on. The first one is that every investment has to make sense compared to the alternatives. Making 5% in a year on a stock sounds better than nothing. But if you can get the same thing from a risk-free U.S. government bond, you should go with the bond.

If you have debt, you are probably paying interest on that debt. We can think about that as the reverse of an investment. Each time you pay down debt, it’s as if you are making the interest back, since you’re not going to have to pay it. Paying down a 10% interest bearing student loan will save you that 10% interest you would have paid.

If your alternative is a surefire 15% in the stock market, you’d be better off not paying the loan off early and instead investing in the stock market. But, and don’t worry too much about these numbers now, if you see a ‘surefire 15%’ in the stock market, please let me know, because I’ve never seen such a thing. I’d argue it doesn’t exist.

There are nuances to how fast you can pay debt, and it’s possible to start investing while still having some debt, but I would try to get the debt load as low as possible. I would especially take care of anything that you pay a high interest rate on. Using a credit card to build up a credit history is fine; paying interest on your credit card is wasteful if you can avoid it.

I said don’t worry about numbers too much, but as a loose rule of thumb, if the interest rate on your loan or debt is above 6-8%, I’d focus on paying that down before you invest.

The debt exception: mortgages

One big exception: a mortgage on a home you live in. This is an exception for 2-3 main reasons.

- First, it’s not totally an exception because most mortgages in the U.S. are below that 6% threshold.

- If you are living in this home, your mortgage payments are taking place of your rent. Your mortgage payments should amount to part of your monthly expenses, which we covered in ‘make more than you spend.’

- You can consider your house to be an investment. Housing prices do tend to go up, at least in the U.S.

That’s no guarantee, and we’ve had housing crashes in the past and will again. It is also not so bold to say that if you are living in a house, and you expect to stay in it for years and years, you have a decent chance of selling it for more than you bought it.

Whether it’s a good investment for you to buy a home depends on the price you pay, the renting alternative, and a number of other factors. But if you have already bought a home, it’s reasonable to have that mortgage on your balance sheet while also starting to invest in the stock market.

Which brings us to our next point…

Build up a rainy day fund

The second fundamental principle to keep in mind for investing is that for you and me as individuals, our biggest advantage in investing is time.

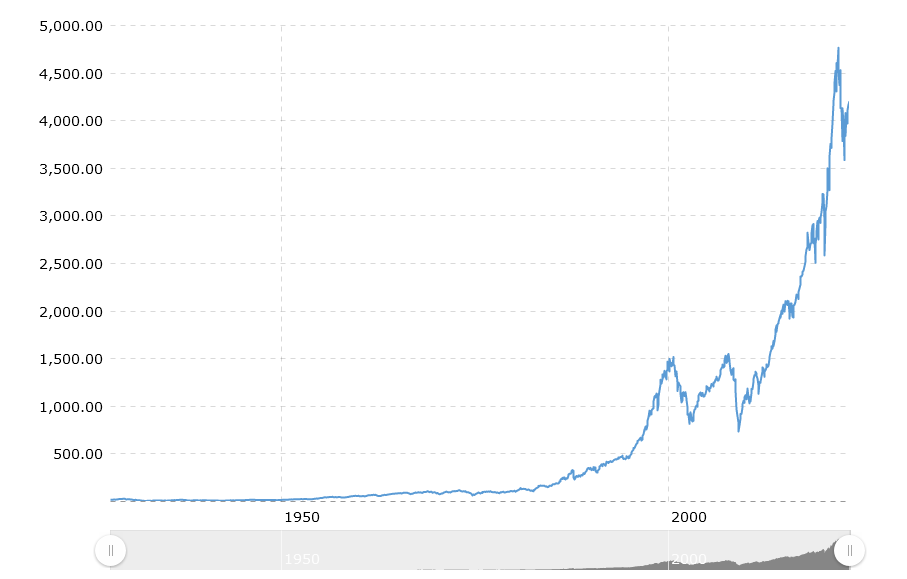

Like house prices, stock market prices tend to go up over time. A bad year – like 2022 – can happen. A bad month – like March 2020 – can pop up. But when you zoom out, investing in the market tends to pay off.

S&P 500 performance chart 1928-2023. Source: Macrotrends

Life happens sometimes, and that can shrink your time horizon. You get sick and your insurance doesn’t fully cover it; you lose your job; you have a huge, unexpected expense pop up.

What the rainy day fund does is put a buffer between you and your investments. When something goes wrong – and stuff happens to all of us – you can cover yourself without hurting your investing advantage, time.

A good rule of thumb is to have money that can cover 3-6 months of expenses kept in a savings account. This is money you can withdraw whenever you need it, but that you don’t use for day-to-day expenses.

If you are more conservative, maybe you cover 3-6 months of income or even up to 12 months of either expenses or income. Whatever you think will allow you to get through bad events without forcing you to pull your money out of the stock market.

Have enough money to invest

You are making more than you spend, so you can save money.

You’ve paid down any high-interest debt.

And you have an emergency, break in case of big problems savings account to use when you need.

The last step of the pre-investing process? Have money to invest!

This is pretty straightforward, and there’s no magic rule. In 2023, brokerages in the U.S. and many other countries require no minimum to open an account and offer no commission-trading. So you can get started with as little money as you’d like.

But, for the time that it takes for even the simplest style of investing, and for you to feel like you are investing a real amount that will have an impact on your life in the years and decades ahead, I suggest building an initial nest egg of $5-10K before you open your brokerage account. That’ll make it so the growth you can hope for in the years ahead is worth the effort to set up your account.

If you are antsier to start right away, you can go for it, especially if you expect to invest your savings regularly over time. But, patience is also part of the game, so I think this last hurdle can be a useful one. It’s like a final marshmallow test before investing in the market.

Once you’re ready to start investing

Where to next? In our next video and article, I talk about the three paths to investing, the three roads we can start down in our investing journey.

Subscribe to get these posts in your inbox, and check out that next post here.

Subscribe to get A Short Investing Guide!

3 responses to “What to Do Before Investing”

[…] What To Do Before Investing […]

[…] What To Do Before Investing […]

[…] What To Do Before Investing […]