I manage money for myself, several family members, and one friend, and find it helpful to do a portfolio review every quarter – i.e. each three months. I plan to share those reflections here as real-world examples of how I’m applying the principles espoused on A Short Investing Guide. Nothing in here is investment advice, and please check the disclaimer vis a vis performance and my disclosures. I hope you find this useful/interesting.

What will the market do? Fluctuate

The second quarter of 2023 was another very satisfactory one for our portfolios and for the market as a whole. But I’ll start our review at our lowest point, to illustrate how much or little the first sentence means.

On May 3, two of the companies we own shares in reported earnings. Earnings are a quarterly event for each company. The company reports the profits and sales it made in the prior quarter, and usually gives an outlook for the next quarter or rest of the year. It also explains why its numbers were what they were. Then the market ‘grades’ the company against analyst expectations and sometimes more secret, whispered about expectations. The result sends the stock in one direction or another, and often provides the momentum until the next earnings report. For all that a stock can move over three months, this is the one consistent time that stuff actually happens.

Axcelis Technologies, our biggest company, reported first. Their report was ho-hum – their numbers for both the prior quarter and outlook were ahead of analyst estimates, but not by a ton. They raised their outlook for the year and boasted of growing at least 12% in a year demand for their type of equipment would drop 20%. A good report, but not amazing.

Then, F&G Annuities & Life, our biggest new buy in the first quarter, reported earnings. Their report was more confusing – as a financial sector company, they were required to account for a bunch of things that don’t directly reflect or affect their earnings power. They reported a loss in GAAP earnings, and an adjusted net earnings amount that was 39% lower than a year ago. On the surface, not great, but it’s not a simple company.

The next day, both stocks plunged. FG dropped 17.2%, their lowest close since returning to the public market in December. Axcelis dropped as much as 14%, though it ended the day down ‘only’ 7.4%. Our portfolio dropped 2.3% as a whole, and I couldn’t even blame a broader market sell-off – the worst performing major index was down only 1.2%.

This is an unpleasant feeling. I could rationalize why FG dropped, and scrambled to figure out whether the investment was a mistake. I couldn’t really rationalize ACLS’s drop except to note that at its May 4th low, the stock was up 32.7% for the year. Sometimes stocks need, as they say, a breather.

I didn’t make any changes to our positions that day.

The funny thing happened after that. The next day, both stocks rebounded sharply, not quite making up for the losses, but not far off. Our portfolio as a whole did fully recover.

Within two weeks, both stocks had closed higher than their pre-earnings level. And by June 30th, Axcelis finished 74% higher than its May 4th low. FG finished up ‘only’ 66%. In Axcelis’s case, the only ‘new’ information was mis-applied excitement over artificial intelligence; in FG, there was one insider buying shares.

All of this is to illustrate the concept that anything can and will happen in the short term, and it may have no bearing on the longer term. If a company is generating cash from its business, the only times the stock’s price matters is when you buy and when you sell. Little fundamental changed about FG or ACLS’s businesses from May 4th to June 30th. That didn’t stop the prices from changing.

I try to imagine ‘what would happen if I was on an internet free vacation for a week? For a month?’ as a way of shielding myself from the emotion that big red or green numbers in our portfolio triggers.

That doesn’t make the emotional part easy, though, and that’s what worries me for the rest of the year.

Subscribe to get more of A Short Investing Guide

The AI market, but also other boosts

The stock market has had an extraordinarily strong start to 2023, even accounting for the fact that it is rebounding from 2022. The Nasdaq had its best first half in 40 years. The S&P 500 finished up almost 16%, a more than successful year.

Many were eager to attribute the rally to excitement over artificial intelligence. Nvidia, a leading semiconductor maker whose graphic processing units are used for training AI systems, reported a blockbuster quarter that ignited a large swath of the market. Jim Cramer came up with the “Magnificent Seven” stocks, the ones leading the market higher. They’re all technology stocks and Tesla, which trades like one.

I haven’t looked up how much of the S&P 500’s growth this quarter was due to these companies (this tweet suggests 82% of it is up to them). Our experience suggests there was more to Q2 than AI or the biggest companies outperforming.

The financial sector recovered somewhat from the regional bank scare in March. Industrial stocks picked up steam to end the quarter as the economy appeared to maintain strength. And for sure, trashier, more speculative stocks did well. The market is giving 2021 vibes.

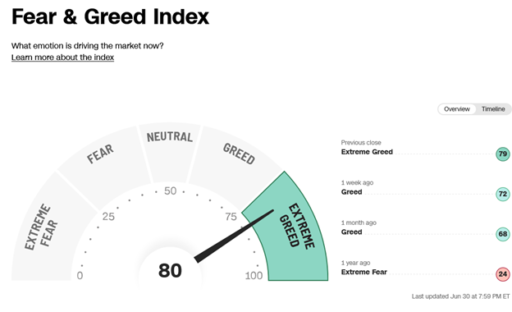

A screenshot from CNN’s fear & greed index as of June 30th.

Our portfolio has benefited from the financial sector recovery, some of the AI hype, the industrial pick-up, and no doubt the speculative vibe.

This marks the third straight quarter our U.S. stocks are up more than 10%. The tricky part is remembering that we didn’t do anything to ‘earn’ that short-term performance. The market will fluctuate, and over the last two months especially, it’s decided to fluctuate higher.

Our emotional challenge is to not fall into the gambler’s fallacy in either direction. In the short term of months and even 2-3 years, anything can happen. In the past 2-3 years, everything has happened.

The market’s mood, as best I can gauge, is verging on euphoria, which is a bad sign. That doesn’t mean that if we look down, we’ll plummet Wile E. Coyote style. But, one can’t ever expect their stocks to go up 10% in a quarter. Let alone four times in a row.

We’re investing in companies for their earnings, and not their mood. I’ll work to focus on those.

It’s easier to write all that based on how I feel on July 5th than May 4th. It’s also more important to remember that now than it was then.

Our Q2 portfolio review

| H1 2023 | Q2 2023 | Q1 2023 | 2022 | 2021 | 2020 | |

| U.S. portfolios | 33.9% | 11.9% | 19.6% | -10.7% | 19.1% | 11.1% |

| Russell 2000 | 7.2% | 4.8% | 2.3% | -21.6% | 13.7% | 18.4% |

| S&P 500 | 15.9% | 8.3% | 7.0% | -19.4% | 26.9% | 16.3% |

| Nasdaq | 31.7% | 12.8% | 16.8% | -33.1% | 21.4% | 43.6% |

| S&P 600 | 5.1% | 2.9% | 2.1% | -17.4% | 25.3% | 9.6% |

| European Portfolios | 8% | -2.5% | 10.7% | -15.3% | 4.5% | 16.4% |

| Euro Stoxx 50 | 16% | 1.9% | 13.7% | -11.7% | 21.0% | 3.5% |

| DAX | 16% | 3.3% | 12.2% | -12.3% | 15.8% | -6.3% |

See Disclaimer at end of post.

Key Portfolio Stats

- Our portfolio level price to earnings multiple for trailing 12 months (TTM) was 21.19*, or a 4.72% yield. Our price to free cash flow TTM ratio was 17.38, or a 5.75% yield.

- Cash and equivalents (the ETFs MINT, JPST, SGOV, and BIL, and 13-week U.S. treasury bills) was 21.6% of our quarter end portfolio, with an average yield of 3.9%.

- We bought 49% more equities (in dollar amount) than we sold in Q2. For H1, we sold 15% more equities than we bought.

*I adjusted earnings for impairments on WWW and AER in the last 12 months; took FG’s adjusted net earnings; and BRK.B’s operating earnings. Free cash flow is a shakier number due to the number of financial companies we own. The numerator is the total value of our long equity positions as of the end of Q2.

Our ten biggest equity positions at the end of Q2 were:

- Axcelis (ACLS) – 12.1% of our portfolio

- Grupo Aeroportuario del Centro Norte (OMAB) – 5.5%

- Dropbox (DBX) – 5.4%

- Discover Financial (DFS) – 5.1%

- Progressive Financial (PGR) – 5%

- F&G Annuities & Life (FG) – 4.5%

- Arlo Technologies (ARLO) – 4.4%

- VMWare Inc (VMW) – 4.1%

- Apple (AAPL) – 4%

- Booking Holdings (BKNG) – 3.3%

- Atkore Inc. (ATKR) – 3.2%

- Grupo Aeroportuario del Pacifico (PAC) – 3.1%

Top winners (performance as % of starting portfolio level for quarter):

| ACLS | 3.3% |

| ARLO | 2.2% |

| FG | 1.4% |

| DBX | 1.2% |

| DFS | 0.9% |

| AAPL | 0.7% |

| VMW | 0.6% |

| ATKR | 0.5% |

Top losers (performance as % of starting portfolio level for quarter):

| PGR | -0.4% |

| PAC | -0.3% |

| OMAB | -0.2% |

| Juniper Networks (JNPR) | -0.2% |

| Mosaic Co. (MOS) | -0.1% |

Notes on Winners/Losers

OMAB, PAC, and Progressive were in the losers category after being winners in Q1. Progressive is struggling with profitability as the severity of insurance claims remains really high due to price inflation in used cars. The whole industry is struggling and PGR seems to be doing better than their peers – State Farm, Geico (part of our portfolio company Berkshire Hathaway), and Allstate. OMAB and PAC appear to be victims of the normal ebbs and flows of the market.

Dropbox was the reverse, a leading loser last quarter. They announced job cuts that would in part allow them to hire AI focused employees to develop in that area. This seems to be a non-event to me, but the company is still reasonably priced and a logical acquisition target.

Arlo’s quarter made clear that they will be free cash flow positive (though with heavy share-based compensation) this year. There’s a clear path to it becoming quite profitable in a couple years. Its subscription business – buy multiple cameras for your house, and then pay to have access to security videos through an app – is the sort of business the 2021 market loved, and the 2023 market seems to be a fan as well.

VMWare was one of my mistakes this quarter. It is in the process of being bought by Broadcom. I sold some of our shares in early May, content to lock in a small long-term gain in case the deal falls through. The spread between the offer – a mix of cash and Broadcom shares – and VMW’s shares was 20%, and the Broadcom part was 27.6% higher. I don’t like merger arb and was just thinking of the cash portion of the deal, so I moved on, except for in our two biggest portfolios.

My mistake was not thinking enough about receiving Broadcom shares. I don’t know if I should have anticipated Broadcom taking off because of AI hype. It did, with shares rising 36%, widening the spread to ~30%. Meanwhile, reports suggest the merger is progressing, and it strikes me as a hard merger to block. I bought back some of the shares I sold, and would like to buy more if I get a good chance.

I struggle with averaging up – buying more shares of a stock for a higher price than I initially bought shares. Atkore, a smaller position we had, offered a chance to work on this. The company sells pipes, conduits, and electrical and infrastructure parts. The market assumes its earnings of the last couple years were due to an unsustainable inflation/supply chain boom, and that they would recede. Atkore has set a long-term (2025 and beyond) target of over $18/share, and they are probably going to clear that bar this year. Even with its rise towards the end of the quarter, it sells for 8.7x that $18/share earnings number, is buying back a lot of shares, and does not have a lot of debt. I may have to build the averaging up muscle more.

New Positions

Charles Schwab

I bought shares of Charles Schwab, coincidentally our brokerage via their ownership of TDAmeritrade. SCHW sold off heavily in March. The sell-off was correct – Schwab’s profit center is its banking operations. We deposit money into our brokerage accounts, keep some of it in cash, and they can invest that cash in higher interest activities. But with the rapid rise in interest rates, we and other investors are ‘sorting’ our cash by putting it into higher-interest positions*. This means Schwab will make less money from interest – they’ve already announced a likely drop of 10-11% in revenue in Q2 vs. 2022. On top of that, some of Schwab’s investments in long-term bonds have lost value due to the same interest rate rise.

*To illustrate, only 19.5% of our cash position is in actual cash that Schwab could theoretically invest.

A former Seeking Alpha colleague and I have had a long-running debate. His contention since the mid 2010s (and no doubt earlier) is that rising interest rates are not automatically good for banks, and one has to look at the balance sheets more closely. My contention is that the then consensus was that rising interest rates were good for banks, and so it wasn’t an unreasonable argument for authors to make in articles about banks. His argument is of course stronger, and he dm’d me with a victory lap in March.

But I think Schwab (as well as Discover Financial) illustrates we should not over-learn this lesson. Higher interest rates, once they’ve stopped rising so rapidly, give banks more room to maneuver. It’s correct that Schwab’s near-term earnings will be hit. I would also be surprised if their net interest margins for 2024 and beyond will not be above 2021 levels, which would mean their earnings would be ok. And Schwab’s leadership as a brokerage seems to be unaffected by all of this, which is more important.

This is a 1.9% position for us, and I am likely to buy more.

I should note there were a couple articles I found valuable in considering this position, as discussed in this video.

Steelcase

It seems like every company is cheap on the surface but at risk of decline – like Atkore – or likely to have poor results for the next 6-12 months but already recovered to 2021 levels – many tech companies. Finding a company that has room to improve but is not a lost cause is hard.

Steelcase is a leading office furniture dealer that trades at 9x trailing free cash flow and 19x trailing earnings with a reasonable balance sheet. Its margins are much lower than before COVID, and its sales are a good bit lower as well. Which, of course – many people work from home now, hurting office furniture demand.

I am a big advocate of remote work. I think it’s likely, though, that 5-10 years from now, we will be working more in offices than we are right now, if not as much as pre-pandemic. This should help Steelcase. Their peers are going through what seem like challenging mergers – MillerKnoll* – or new mergers – HNI, which bought our company Kimball last quarter – or are private – Haworth. MillerKnoll, Haworth, and Steelcase are West Michigan companies, and I’m hoping to do a little investigating this summer when I visit Ludington.

*MillerKnoll’s CEO starred in the “pity city” video

This is a 2.3% position for us.

Smaller positions

I took relatively trivial positions (.3% of the total portfolio each) in Dallas News and Bassett Furniture. Bassett appears really cheap, and I came across it while looking at Steelcase (Bassett is a home furniture maker, not office). It led me to this good book, so I’m up on my position entertainment wise at least. I saw an intriguing pitch for Dallas News, love newspapers, have met or followed a couple people from the Dallas Morning News, and the case makes sense. It’s a tiny company ($21M market cap) and my position is tiny.

We bought a small position in Daikin, the leading air conditioner manufacturer in the world, in our European portfolio. Shares are not cheap, but air conditioning demand is only likely to grow in Europe and elsewhere.

I opened two short positions in Sprout and Vicor, following my podcast co-host Akram’s ideas. I’ve never directly shorted a stock before, so this is as much for experience in understanding the process as anything else. The positions are tiny (less than .1% of our combined portfolios) and only in my personal portfolio.

Closed Positions and other notes

- We sold Honeywell out of our portfolio as discussed in last quarter’s note.

- National Technologies played out mostly as expected – Emerson won the bidding with a $60/share offer. The only surprise is how long it will take them to close the deal. We sold at about $57.61.

- We sold our PSQ hedge at a small loss – I re-learned that shorting the Nasdaq is not a good hedge for our portfolio. I added a little to our RWM hedge, which shorts the Russell 2000 and better mirrors our portfolio.

- We added to our position of Juniper, though mostly because it was undersized in our portfolio.

- We took gains in Spotify (now a 1.7% position), Axcelis, OMAB, and Arlo, as well as what I mentioned vis a vis VMWare. We took losses in Wolverine Worldwide and own only a tiny position (.2%) still.

Disclosure: I am long or short all positions mentioned in this article. I may change positions at any time. I have no immediate plans to make major changes. This is not investment advice. Investing is risky. Any investing decisions are your own responsibility and should be taken after speaking with an advisor or at your own risk. This is not a solicitation to buy or sell anything. Past performance is of course no promise of future results.

Disclaimer: I calculate performance and all portfolio figures myself, manually, so it may be prone to error. The accounts I manage may deposit or withdraw money over the course of a quarter. I account for that in my calculations by adding/subtracting that money to/from the starting amount at the beginning of the period. This means withdrawals intensify performance and deposits dampen it. For half-year and full-year performance, I multiply quarterly performance by one another to control for deposits/withdrawals. If there’s a better way to calculate, please tell me!