Indexing is the most basic way to get into the stock market. It is also, for most of us, the best and most profitable way to invest in the stock market. It’s what Warren Buffett says we should do. Without giving specific investment advice, it’s what I think is the best option for most of us.

You may have heard this all before – it’s not terribly original – and still not know how to index.

What is indexing? How does one do it? What do you need to know?

This post will go over the basic steps to investing in an index fund, or indexing.

Open a brokerage account

Before you do anything else, you have to open a brokerage account. This is an account with a company that will enable you to buy stocks, bonds, or funds, using your money.

Selecting a broker

Here’s a basic checklist for what you want in a broker:

- Low-cost trading – zero commissions on trades, no minimum fees

- Trading in stocks and ETFs (exchange traded funds)*

- Long track record, an established company

*In Europe, make sure you can trade the stocks/ETFs themselves, not derivatives like contracts for difference (CFDs)

In the U.S., I would look at companies like Charles Schwab or Fidelity. I use TDAmeritrade, which is owned by Charles Schwab. They all offer zero commission trading, solid customer service, and a track record that suggests they are going to take care of your money and your positions well. I would avoid Robinhood, which is both unproven and encourages the wrong sort of investing.

I can speak less about other country’s best brokerage options. In Spain, I came across Degiro, which seems like a newer but still credible low-cost option in Europe*. Interactive Brokers is available globally, but is more suitable for advanced investors.

*I am not able to open an account with it as a U.S. citizen, so I have no firsthand experience.

Opening an account

Once you select your broker, you can open your account*. You will have to fill out some information – your investing experience, who you are, that sort of thing. Then, you’ll have to transfer your money from your bank account to your brokerage to start investing.

*I am going over the process for a standard brokerage account, not an IRA for U.S. investors. The process is roughly the same; we will cover IRAs later.

In our pre-requisites to investing, we said we wanted to have $5-$10K to invest. Once you open your brokerage account, you can transfer that money from your bank account. Once you transfer the money, it might take a couple days to appear in your account, but once it’s there as part of total cash, you’re good to go.

Pick the index fund to buy

Now you have to decide which fund to buy. We’re going to keep this as simple as possible.

First, remember what an index is and why you would buy it: an index is just a collection of stocks that is meant to represent a wider part of the market. The S&P 500 includes 500 of the biggest companies in the United States; the Dow Jones Industrial Average includes just 30 of the biggest companies; the Nasdaq 100 includes the 100 biggest companies on the Nasdaq exchange.

They have different characteristics – the Nasdaq is more focused on technology companies; the Dow Jones has stodgier companies. Investing in these indices means instead of tracking and picking individual stocks, you get a basket of some of the biggest and best companies in the world, at no effort on your part.

We’re going to index using the S&P 500. I think it’s the best general representation of the U.S. market. The Nasdaq is worth considering and I will discuss that in a future post, but the S&P 500 is the most basic option. The Dow Jones Industrial Average is, to be blunt, not worth considering.

We’re not going to actually invest in the index, we are going to by an index fund using an ETF. An ETF is an exchange traded fund – basically a mutual fund, except you can buy and sell them whenever you want. An index fund is a fund that mirrors a given index, the S&P 500 in our case.

The two most notable S&P 500 index funds are SPY and VOO*. They do the same thing – try to follow the S&P 500 so that someone who wants to invest ‘in the market’ can choose either fund. The main difference is that VOO charges .03%, while SPY charges .09%. So for every $100, you pay Vanguard, which manages VOO, $.03 a year, while you pay State Street, manager of SPY, $.09.

Neither is very much, and the difference isn’t big, so if you have only SPY available in your 401k plan, for example, that’s fine. But part of the reason index funds work is because they’re so cheap, so you may as well go with the cheapest credible option. VOO is our choice.

*In a later post, I’ll add an additional wrinkle, which is the option to select an equal-weighted fund instead of a capitalization-weighted fund like VOO or SPY. But it’s not necessary for an introduction.

How do you buy an index fund?

Once you have money in your account, and you’re set on VOO, it’s time to buy shares.

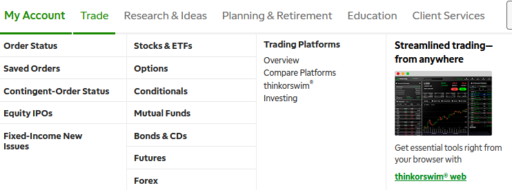

In your account, look for a button or menu item such as trade, or buy/sell. Click on this, and you’ll either see a box where you can enter details for a trade, or you will see a mouseover where it shows a bunch of stuff. We’re buying ETFs here, so you want to click on that option wherever you can find it.

A TDAmeritrade screenshot. Here, we want to mouse over the trade button and then click on Stocks & ETFs.

Select buy. You will have to enter the ticker symbol for the fund you want – VOO in this case – and then make a few choices.

You have two options of what type of order to make for your buy – a market order or a limit order. A market order just finds whatever the market price is. A limit order allows you to say what the top price you will pay for the fund shares is.

I normally use limit orders, to give me control over price. That saves me some dollars, but it also risks missing out on a trade. In the case of an index fund, it makes sense to use a market order. A market order is simpler, and because of how popular the funds are, you won’t be missing out on something by taking the market price.

How much to buy? Assuming we’re investing all at once, you just need to divide your initial amount of money buy the price of the fund. If VOO is at $382 and I have $10000, I can buy 26 whole shares, or 26.17 fractional shares if my brokerage offers this. This is the only math you have to do. Some brokerages, such as Fidelity, allow you to enter a dollar amount without doing the math. Others, like TDAmeritrade, provide a share calculator on the buy page. So they make it easy.

Confirm your order looks right – that you got market or limit right, that your limit price is right, that you are buying not selling*, that it’s the right amount, and that it’s the right ticker symbol. Then, confirm the purchase.

*Yes, I have made this mistake before, buying when I meant to sell.

If the market is open and you made a market order, the purchase will be made and you will see the VOO shares in your portfolio. For a limit order, you will have to wait for your price to be matched in the market. If for whatever reason something went wrong, the order won’t go through and your broker will show an error message.

Do all that, and you are indexing. Congratulations.

The most important part

Buying, though, is the easiest part of an indexing strategy. Most important is to continue to buy more shares over time as you save more money, and to hold your shares. Holding index fund shares for months and years is how the market will work in your favor. Through good times in the market and especially through bad times in the market. You will buy at higher prices and lower prices, but over the years and decades that will even out.

The three things we are doing when we index are:

- Investing for the long term so the market works in our favor

- Investing in a cheap fund so we don’t have to lose too much in fees

- Investing in the market as a whole to benefit from its overall growth.

Keep it simple, do all that, and you can stop your investment journey here. Because this is really all most of us need or want to do.

Subscribe to get more of A Short Investing Guide

If you want to do more, or just to learn what about what is happening in the market that drives an indexing strategy forward, sign up for future posts. We will be starting our course on how to buy stocks next, so stay tuned.

3 responses to “How to Index and Invest in an Index Fund”

[…] up: how to actually start indexing, the first and simplest path on our investing […]

[…] Short Investing Guide’s How to Start Investing course culminates in a “How To Index” post. If you stop there, I would be happy for you, that’s all you need to get […]

[…] and flow, trends come and go.If you’re spending extra time on investing actively – instead of indexing – you should enjoy what you’re doing. It’s ok to think of your investing style the way you […]