We learn a lot from mistakes we make, or other people make. But there are mistakes we make, and mistakes we don’t make, if you catch my drift. As the Wayne Gretzky (and Michael Scott) line goes, you miss 100% of the shots you don’t take.

A more scientific term for what I’m getting at is errors of omission. If errors of commission are things we do that we shouldn’t have, errors of omission are things we didn’t do but should have.

I have an example of that today from my recent investing history. We’re going back to late 2022, and reviewing how I messed up in not buying Duolingo stock.

Passing on the IPO – good call

My Duolingo story starts a few days before the company went public, in the summer of 2021. I didn’t realize the company was planning to IPO. Rosetta Stone was an older competitor that I had followed when it was public. I love learning and speaking other languages. And while I hadn’t used Duolingo yet, this seemed like an opportunity to try it out and research a company.

Duolingo’s S-1 – the form newly public companies file to introduce themselves to public markets – was impressive. The company’s business model had a lot of strengths, and the company was growing quite fast. It was also a model that I could understand and appreciate.

Basically, Duolingo provides language courses that feel like video games. You follow quests and activities, win gems, buy power-ups, and compete with peers, except you’re practicing Spanish or Italian or English or Arabic or what have you. The app has several characters, Duo the owl most notably. The language exercises include matching vocabulary, filling in the blank, listening and repeating, and completing stories, among other activities.

It’s not an amazing teaching tool, and it’s not meant to be. Duolingo has been quite public that the goal of the app is to open the door to language learning, and make it more fun and engaging. I tried the app for a few weeks in the summer of 2021, and it didn’t’ quite engage me. But I signed up again in March 2022 and have stuck with it since. And even though I finished a course and can’t speak that language, I have found it useful at brushing up on certain things.

Duolingo’s business advantages

While we shouldn’t forget to think about the quality of the product, the business matters most to investors.

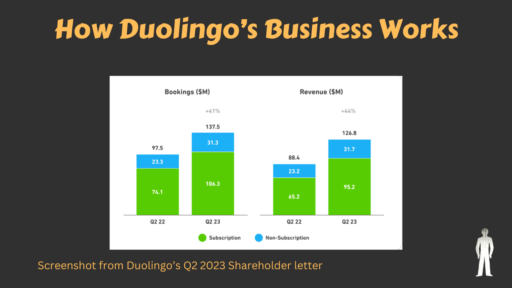

Duolingo’s business has two nice dynamics. First, it has two bites at the apple for making money. A user downloads the app, uses Duolingo, and sees ads. This amounts to 10% of Duolingo’s revenue. If the user gets tired of the ads, or wants more features, they sign up for a subscription. This is 75% of Duolingo’s business. The remainder are English certification tests (8%) and in-game power-up purchases (7%) (all numbers rounded).

The two bites are that Duolingo can acquire a user and know it will make some money off ads. And then if it is successful in ‘hooking’ the user, the user might sign up for a subscription. It makes it cheaper for Duolingo to acquire subscribers, since they can make money at an intermediate level.

The other dynamic is common to most subscription businesses – Duolingo collects money upfront for annual subscriptions, meaning it gets cash early. This means its free cash flow will be higher than its net income as long as it’s growing, and will make the company less reliant on the market to raise money.

One more intriguing dynamic: Duolingo was both a Covid winner and a reopen stock. Lots of new users flocked to the app while bored in lockdown and looking for constructive activities. But many others would want to brush up on foreign languages as they started traveling again. That created a dual tailwind for Duolingo’s business. How about Duolingo stock?

Strong company, expensive stock

I’ve said I want four things in a company and four things in a stock. I found the following from Duolingo (you can see my 2021 analysis for how I framed it at the time):

Revenue Growth: Very strong. It was expected to be around 53% in 2021 at the time of IPO. I thought it was clear revenue growth would continue, though Covid dynamics would skew things a little.

Business I can understand: Clear to me. I understand language learning reasonably well to understand the product. And I’ve worked in a place where we had a subscription business as a core, but also a free user funnel.

Control of destiny: This was a little mixed. Duolingo’s financial control was great, due to all the cash on their balance sheet post-IPO and the free cash flow I mentioned. But as a primarily mobile app business, it had to pay app store taxes to Google and Apple, amounting to 30% of its first year of subscriptions and 15% of the second year. This would put a cap on margins.

Efficiency: This was the weakest point for Duolingo at IPO. It pledged to continue investing heavily in research & development. It said sales and marketing costs would slow down, but those had spiked dramatically before IPO. And there’s the gross margin cap from the app stores. It was hard for me to see how long it would take for Duolingo to be profitable.

Still, there was a lot to like about Duolingo as a company. What about Duolingo’s stock?

Absolute Valuation: The company was not profitable, and the earliest I could get it to profitability was 2023 or 2024. Duolingo was selling it IPO shares at 15.5x sales. That’s a high number, even as fast as Duolingo was growing.

Relative Valuation: Rosetta Stone was bought out at 3.75x sales. This was a weaker company, in my view, so maybe you could argue Duolingo was worth twice that in a worst case. Still, 15.5 is more than twice 3.75. Duolingo was also pricey compared to the market, and we had no historical track record to look at.

Reason for Disconnect: I’ll cover this in a moment, but let’s say there was no clear disconnect.

Risk/Reward: Without profitability to think through a downside, the best I could do was use that twice Rosetta Stone number. Which got Duolingo to $50/share or so. Its shares closed the first day of public trading at $139.

As much as I was intrigued by the company, investing at IPO was a no go for me.

The Problem with IPOs

There’s good reason for that. IPOs – initial public offerings – are tricky to invest in.

Companies are selling a large piece of their business for one of two main reasons: they need money to invest in the business, or they want to cash out. While that’s important for the economy and normal, neither reason is inviting for new investors.

Beyond that, companies prefer to go public when the so-called “IPO Window” is open. That is to say, when markets are more buoyant and frothy. A company wants to raise as much money as they can.

Summer of 2021 was still a frothy time, and a good one for Duolingo to go public. It originally planned to price its IPO at $85-$95 a share. It eventually priced its IPO at $102, and shares closed at $139, as I said above.

All this is happening before Duolingo has set a track record for public performance. There are variables in terms of how the company will perform and how the market will price its stock that you can’t know until it’s public. And given IPOs start from a point of euphoria, it’s hard for things to get better.

If you managed to get Duolingo shares at $102, things worked out ok for a while. But that initial pop gave way to market gravity, as it often does.

Duolingo stock gets interesting

Duolingo’s public career as a stock started perfectly, at least from my perspective.

The company did great. It beat analyst expectations for sales and earnings every quarter. It raised its guidance for earnings, bookings, and sales regularly. Companies can manufacture this sort of run by setting expectations low, but Duolingo’s absolute numbers were strong.

55% revenue growth in 2021, 47% revenue growth in 2022. Positive free cash flow both years (though inflated by share based compensation, a separate story). A lot of cash on the balance sheet. Strong user growth, bookings numbers, and momentum.

Duolingo’s revenue growth has continued through the most recent quarter.

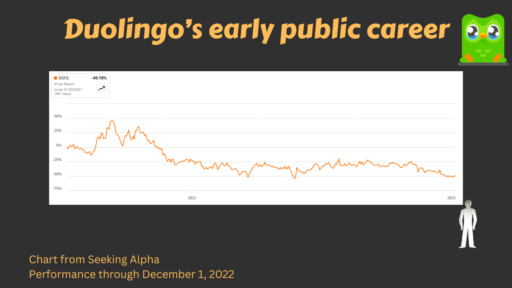

And meanwhile, the stock did poorly. Not immediately – it rose as much as 46% in its first two months public. But by the end of 2021, Duolingo stock was down 24% from its IPO close. And it got worse from there.

There is little better than a stock performing poorly while a company is performing well. And we didn’t have to go far to find the disconnect – Duolingo started out overvalued. As most of the high-flying stocks, and the market as a whole, struggled in 2022, this valuation ‘compressed’, or got smaller.

By December 2022, it was clear the year was a loser for most of us. That amplified how much losing stocks went down, as investors sold them to generate tax losses. If we had the stomach and patience, then, December 2022 was an interesting time to buy stocks, especially in high quality companies that had sold off.

Duolingo wasn’t a perfect buy – the company wasn’t yet profitable, and the valuation wasn’t cheap. But, some of the company aspects had proven to be better – Google had lowered the Google Play Store fee, for example – and the stock had gotten a lot better. So, I bought, right? Well…

How the Duolingo mistake played out

I’ve talked about how I like to buy stocks using limit orders. I decided Duolingo was worth an investment, and put a limit order out for $60.

And of course, Duolingo’s stock bottomed at $65. Meaning, I never got to buy its shares.

I’ve used this as the example of the perils of limit orders, but really, the issue is more fundamental. On the one hand, I wasn’t sure I wanted to buy Duolingo shares, or not sure enough to realize that a price below $70 was likely to be as low as I’d see for a long while. And on the other hand, I stayed anchored to this idea that $60 would be the most I’d pay for the stock.

$60, to translate it, was about 5x EV/sales. I had previously said you could argue it was worth 7.5x as a worst case scenario. But as the market got more bearish about everything, I adjusted my wants. And as a result, I missed out.

What did I miss out on? Duolingo’s shares bottomed at a close of $65.38 on December 28th, 2022. They closed February 28th, 2023, at $90.79, 39% higher. This was before any real news from Duolingo came out.

Then Duolingo published earnings for Q4. Shares jumped 22% that day, and closed March 31st at $142.59/share. That’s another 57% in March, and a 118% rise since the bottom in December, more than a double. Shares have bounced up and down and are about flat since then, as I write this on October 31st, 2023.

So, for not adjusting my order by about 8-10%, I missed out on more than a double in a stock I understand and liked. That isn’t fun.

Lessons Learned

After the fact, all that looks obvious. A January effect is not a huge surprise, Duolingo had operating momentum, and so on. But that’s not the big lesson, because sentiment is impossible to predict. Instead, I take four lessons from this example:

1. You don’t deserve every return

It’s easy to say I was following Duolingo and could have seen the opportunity. But I clearly didn’t see enough of the upside to feel excited about buying at $65. And even if I had, a double in 3 months would have spooked me, and I’m sure I would have sold some shares along the way (and if I did it after a double, I might have been ‘right’, given how the stock has stagnated).

There are so many investing styles, and so many ways to make money in the market. We will miss out on so many opportunities and big winners. And that’s ok. If you haven’t done the work to understand a stock well enough to understand when it’s on sale, you don’t deserve to benefit from its rise.

As well as I may have understood Duolingo, I didn’t see it yet. I was dipping my toe in, not plunging. That the stock u-turned higher, I didn’t see coming at all. So I didn’t deserve to make money in it.

2. There are other fish in the sea

The general outline of “company that has positive free cash flow, good growth, good product, is in tech, in an industry/market I like, and that I think can continue to grow” isn’t unique to Duolingo. It’s not super common, but there’s another company I often compare Duolingo to. It also has the “two bites at the apple” dynamic, for example.

That company is Spotify. I did invest in Spotify in November and December 2022. Like Duolingo, Spotify wasn’t profitable yet. Like with Duolingo, I wasn’t super confident in Spotify, so I only opened a small position. In Spotify’s case, I bought in the $90s at first, and then bought more around $75. My timing was luckier.

And it played out similarly – the stock more than doubled, as the general tech bearishness last year faded, and Spotify continued to grow while also improving profitability.

Which is to say, you can’t win ’em all. Don’t beat yourself up too much about missing an opportunity you were sure about. There will be other opportunities.

3. Keep doing the work

This ties back to #1. To deserve a return in a stock, you have to keep following it.

I’ll talk about portfolio construction later, but I like the idea of owning 8-10 stocks as an individual investor. Adequate diversification so no one stock will torpedo your future, but it’s possible to follow 8-10 stocks closely and for your winners to make a big difference.

From there, a watchlist of 15-20 companies you like whose stocks you don’t like is worth keeping. And we should follow our watchlist as closely as we follow our stocks, either to discard those stocks from the watchlist or to pounce when the time is right.

I wasn’t following Duolingo closely enough and hadn’t adjusted my forecasts to factor in Duolingo’s improved growth, or continued gross margin challenges, or tapering off sales and marketing spending or so on. Because of that, I didn’t develop enough confidence about Duolingo at $65/share. Maybe I never would have, because it’s not my type of investment. But I didn’t do everything I can to understand the situation at $60.

Whatever the size of your portfolio, it’s always worth keeping an active watchlist. And active means really knowing what’s happening with those companies.

4. Don’t get too cute with entry prices

It’s easy to say “don’t set your limit price at $60” when the stock is $65. But I think the broader point is more important.

Had I done the work, I probably could have made a case the stock could be worth near the current price in a good scenario. I could have assessed the risk/reward as favorable. And at that point, the difference between 100% upside and 110% upside would have felt silly.

I’ve said I like 50% margin of safety as a rule of thumb, meaning at least that much upside. That’s a rule of thumb. There will be times where I feel more confident about a stock’s risk/reward, and can accept less margin of safety. Or times where I just have a gut feeling, that I want to own a stock.

You need to be careful about straying too far from your guidelines or rules. But flexibility is a valuable skill for the investor, especially for one with experience.

Finishing the Level

You will make mistakes on the stock market. What’s brutal about investing is even when you get something right, you will think, “Ahh, I should have invested more in that stock.” There’s no perfect scenario.

Some of our mistakes will be the things we should have done but didn’t. I gave an example of that here. My lesson isn’t “just buy every stock you like”, because that would have played out poorly if I invested after Duolingo’s IPO. And it might still play out poorly – Duolingo has threats from ChatGPT and AI related tools, and its growth may slow down. The future is unknowable.

Continuing to do the work of understanding a company, a stock, and a situation is a common thread. And then, hopefully these smaller lessons will help you understand where you might be your own worst enemy. That’s how I was in this situation. I hope to do better next time, and hope you can avoid or lessen my mistake. That’s how it goes.

Next time, I’ll cover either one more success story or another mistake, but one I actually committed rather than omitted. Stay tuned.

Disclosure: I have long positions in Spotify (SPOT) and Apple (AAPL). Nothing in this post is investment advice.