So far, we’ve talked about learning about stocks from quarterly earnings: the financial statements, the earnings presentations, or the earnings call transcripts. This sets a steady, structured, once in three months rhythm. But there are other financial filings we can use to research stocks.

Stocks represent companies, and companies don’t stop working in between quarterly reports. We also can’t just sit in a given company’s office building or factory and watch what’s happening throughout the year. Fortunately, the other financial filings can fill in the gaps for us and help us research stocks throughout the year. In this post, I’ll discuss those financial filings and how they enable us to research stocks better.

8-Ks (outside of earnings season)

8-Ks are not new to us: these are the forms that contain the earnings press release, and often the earnings presentation. They afford the company more leeway than the 10-Q or 10-K forms to tell their story the way they want to tell it.

Companies file 8-Ks outside of earnings seasons as well. An 8-K is required to “announce major events that shareholders should know about.”

That definition is not precise, and some 8-K filings are not valuable. Shareholder vote announcements or filings of what interest rate newly issued debt will carry aren’t meaningless, but are not top priority.

Subscribe to A Short Investing Guide for more posts!

When 8-Ks are useful for researching or tracking stocks

Some 8-Ks are more material, though. A company executive is speaking at a conference and plans to issue new guidance. It is required to file an 8-K as a regulation FD disclosure, basically meaning that those conference goers wouldn’t get an unfair insight into the company. Meaningful 8-Ks can also announce a dividend raise or cut, or a new company plan.

Often, I’ll notice a stock of mine moving 4-5% in either direction. It’s not earnings season, and I haven’t seen any news yet on the company. I check its press releases and then its 8-Ks on EDGAR, the filing database. That’s how I learned that Discover Financial was restarting its buyback program last November, and that Dropbox would meet or beat guidance in Q1, but was also laying off 16% of its workforce in April of this year. In both cases, the company did not issue a press release, only an 8-K.

This information helped me reactively, to understand what was happening to my stocks. But sometimes it can be an important go-forward signal – Discover has again suspended its buyback, and the stock is near 52-week lows. If it were to announce the buyback was restarted without publishing a press release, the 8-K would be an important sign that DFS’s business was doing ok, and it might affect whether I would buy more shares.

Insider trading forms (Form 3 and Form 4)

Insider trading can mean two things. There is the illegal form, where someone with inside, material nonpublic information about a company makes a trade – the company is about to miss earnings estimates, or is about to be bought out, and the insider sells or buys accordingly, before the underlying info becomes public.

Then there are legal insider trades, sometimes called insider transactions. The executive team of a company will have shares in the company in most cases, as part of their pay. Indeed, we talked about how we want management to have skin in the game. When a management member owns a piece of a company, they want the stock to go higher. Coincidentally, so do we as shareholders.

Part of what makes these transactions legal is that the executive tells the SEC they made a trade*. This is what Form 4 is for – to announce insider trading transactions. When an executive first starts at a company – or when the company first comes public – the company will file a Form 3, stating the executive’s initial holdings in the company. From there, Form 4 updates on any changes. Form 4s are filed within two days of a trade, so they are relatively up to date (as compared to Form 13F filings, for example).

*The other part is that it is not based on material nonpublic information. Which can be hard to prove, but is not our concern right now.

Using Form 4s for researching stocks or finding ideas

There are entire investing strategies based on tracking Form 4s for meaningful buys and sells, especially buys. The saying goes that insiders can sell for any number of reasons, but only buy for one – because they think the shares offer a good value. Many investors consider a CEO or executive share purchase of a company a good sign to investigate further.

The signal is messier than that. Executives know investors like insider buys, which gives them a second reason to buy shares – to express confidence in the company*. Meanwhile, many form 4 sales filings are part of pre-determined plans to sell shares as executives diversify their wealth. Or they are obligatory sales to cover taxes on new options the executive exercised. They don’t express the executive’s view of the company.

*A relevant example: Philip Frost, a billionaire, is CEO and chairman of Opko Health, an unprofitable healthcare company. Frost would regularly buy shares in Opko, which investors took as a bullish signal. Opko has been a terrible investment for the last decade (down 80% in a decade at this writing). Frost and Opko were accused of pump and dumping by the SEC. Read more in this PDF.

At the extremes, these signals can be valuable. A large buy – say 10% of an executive’s position or more. A huge sale, or heavy regular selling on the other side. And if a company is going through a hard period, even a small insider buy can be a reason to not lose your head. In May, one of my newest stocks, FG, sold off heavily after earnings. I didn’t quite understand why, so I didn’t buy or sell any shares. It was nice to see a director of the company purchase $200K worth of shares the next week, though, increasing his position by 66%. It’s worked out ok – he’s up 67% on that purchase, vs. 7% for the comparable indices.

I should say I find EDGAR’s presentation of form 4s hard to use. There are sites dedicated to insider tracking that you can search for. Since it is not a focus of my investing, I don’t have a good place to point you toward, but you should be able to find them with some googling.

Form 13G and Form 13D

Professional investors file 13G and 13D forms when they take a significant stake in a company, 5% or more. They must file the forms within 10 days of the acquisition that pushed them over 5%, making this too a more recent signal than 13F forms.

The difference between the two forms is in intention. 13G forms are for passive stakes, while 13D forms are for active stakes. Meaning: if an investor buys 5% of a company with no plans to request changes in the company’s strategy, they file 13G. If they instead plan to agitate for change, whether working with management teams or going over those management teams heads to the board or the shareholders, they file a 13D form.

Digging into 13Ds and Activist Battles

13D filings are more interesting, then, and worth reading for a few reasons:

- They will often include the intended changes the investor wants to see at the subject company, or a link to a presentation or website where the investor provides more details.

- Usually, activist investors are the ones to file 13D forms. They are professional investors who are among the most public about how they invest. Reading their logic in investing in target companies can be a good learning opportunity.

- The activist may present analysis on the company in question. Buyside analysis – analysis from people who might buy shares – provides a different edge from other types of analysis. It can be informational about the stock in question, then.

- They will sometimes lead to changes at the company, for better or worse. Activists might push a company to sell itself, or fire its CEO and board, or just adjust their strategy.

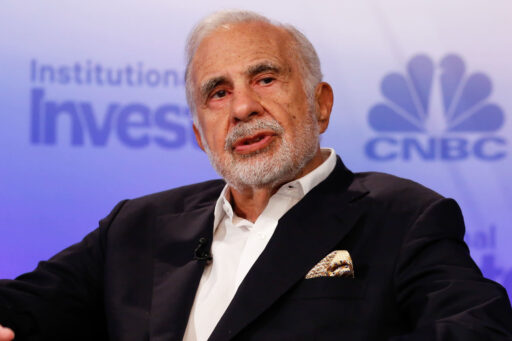

- Activist fights and letters can be entertaining. Activists like Daniel Loeb, Carl Icahn, and Bill Ackman have shown great flair in making their cases for why company management teams are on the wrong track.

Carl Icahn speaking at a conference. Source: CNBC

If a 13D comes out on a company you own, it’s a sign someone’s not happy with the way things are going. It also may catalyze a change. And if a 13D comes out on a company you don’t own, you might enjoy reading it or learning from it anyway, even if the stock isn’t of interest.

Proxy Forms

Proxy forms come out annually, in the months after a company’s 10-K.

These forms can be a little dense, and more advanced. I still don’t use these as well as I should after a decade plus of investing.

Still, there are a few things you can learn from a proxy form:

- A proxy will set out how a management team was paid last year. You can see what the company and management team’s performance goals are. Do they focus more on revenue, which suggests the company will grow at all costs? Or do the goals also have a profitability metric? Which one? This will give you a window into the company’s focus as well as how their managers will try to build the business.

- The proxy will also give you what the company considers its peers or competitors to be. This can be useful for finding how a company sees itself, as well as finding which companies to stack the company up against when you do your analysis.

- You will also find the list of major shareholders in the company. This will tell you if there’s a large family ownership, or two big hedge funds that have over 10% of the company, or if executives and directors own a meaningful percentage of the company. It’s not always information you can act on, but it is worth knowing.

Using financial filings to take your research up a level

There are a few other forms that we’ll cover either in their own category. Forms related to mergers, spin-offs, or IPOs are examples.

The financial filings covered here will help you research stocks and stay on top of the stocks you own already. They will shed a little more light on corners of the company you won’t find in the 10-Q or the 10-K. These filings will help you go to the next level in your investing. Sometimes you’ll find that extra bit of information that most investors aren’t thinking about. But more importantly, these financial filings will show you patterns and behaviors that will translate to your research of future stocks.

All these filings are still coming directly from the company, however. In our last post on where to find info about stocks you are thinking about buying, I’ll talk about sources of information that are not directly from the company.

Disclosure: As of this writing, I own shares in Discover Financial, Dropbox, and FG.