Earnings are like the trimester report card for a business. It’s the most consistent event for a stock to move in a given direction. It’s what matters, or maybe better put, our window into what matters – the business performance.

Last time we talked about the 10-K and 10-Q, the official filings for annual and quarterly reports that tell us about a company’s business performance. They are the full notes on a company’s business, in their sometimes tedious glory.

Today I’ll talk about the simpler version of this: a company’s earnings press releases, filings, and presentations. While the 10-K and 10-Q involves a lot of box checking and official requirements, these formats allow the company more room to tell (and sell) a story.

They are still official documents, based on the real numbers. But here the company highlights the numbers it thinks investors will want to hear. That makes our lives easier and more difficult at the same time.

If we know how to use earnings reports and presentations to our benefit, we can save time and have new insights into the official filings.

Defining terms

When I refer to how to use earnings reports and presentations, there are three ‘formats’ I’m talking about, plus a fourth I’ll cover in its own post next.

- The 8-K

- The press release

- The presentation

These overlap. The 8-K is required, the press release just about always comes out, and the presentation depends on the company – some update their presentation every quarter and others skip it.

The 8-K is what you will find on EDGAR, the filings hub that we talked about last time. It will also include the press release and usually the presentation, if it’s available.

The other place for you to look for these, besides a news website reporting on earnings, is the company’s IR website. Sometimes the press release and presentation will be available here before it’s available on EDGAR. I’m talking about a matter of minutes or hours. This time lag doesn’t really make a difference, but earnings are fun to follow, so maybe you want to hear the news ASAP.

The press release – what’s the difference?

We can always just wait for the 10-Q. So why do we care about the press release beyond time?

Foregrounding numbers

The company will present the numbers it thinks are most relevant here. It may provide more detailed information as well. Using WD-40’s recent earnings report as our example: it provides its sales number by geographical segment, and by product group. The company also provides ‘color’, or explanation for why the results are what they are. This information should be available in the 10-Q, but it is much more front and center here.

Spin

That foregrounding is part of the company spinning their results. They can’t really change the numbers, but they can put it into a story.

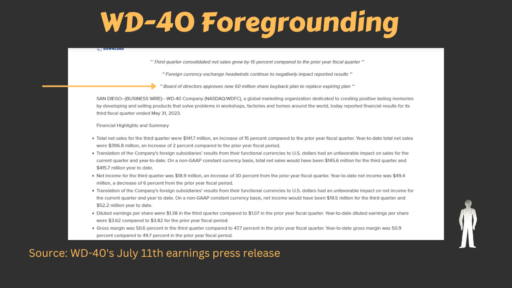

WD-40 highlights 15% growth in the quarter, though it’s only 2% for the year to date. They call out currency as a headwind – when the dollar is strong as it’s been for a year or two, that hurts US based companies’ results.

The press release usually features a quote from the CEO or CFO. In this case, the CEO’s comments highlight the return to top-line growth, spend two sentences lamenting currency, and then use ‘constant currency’ – a way for a company to adjust sales as if exchange rates were the same last year and this year – to put the year to date growth in context. It’s spin, to reframe the results in a way that is favorable for the company.

Screenshot from WD-40’s earnings report.

Announcements

The 8-K will also have any fresh announcements that will be much lower in the 10-Q. Here, we have an announcement of the company’s new share buyback program as a top bullet. If the company makes an acquisition, it is often announced on an earnings day and will be featured here (and in its own press release, if it’s big enough).

Expectations

The company’s financial outlook or guidance is the last big feature of the press release. This is the company’s current expectations for next quarter or the rest of the year, or both. Not every company provides an outlook, and some companies who provide it wait until their earnings conference call to share.

When provided, it is often the most impactful piece of information a company shares on its earnings day. While the report card of last quarter is important and tangible, that quarter is in the past. The outlook for what’s to come is often more important to investors, and it is often ‘newer’ information. If you see a company beat their prior quarter expectations but then the stock trades lower, it’s often related to how it guided for the next quarter(s).

Presentation – or pictures worth 1000s of words

The aim of an earnings press release is in part to make investors’ lives easier, as long as they are willing to take management’s word at face value. What would make our lives even easier? Pictures!

That’s basically the point of an earnings presentation. It takes the story that the company is trying to tell in words and tables of numbers, and puts it in a powerpoint format.

WD-40 does not include their presentation in their 8-K, but you can find it on the company IR page.

The company doesn’t change the information in the presentation. They present their main results – refreshingly, they present the ‘true’ numbers before adjusting for currency. WD-40 spends two pages on the currency impact, echoing the press release. They put segment and geographical details on here, with colorful arrows to highlight which segments went up or down.

Then when they finish covering the quarter, a company will often review their longer-term story. What is WD40 trying to achieve as a company? WD40’s goes more detailed than a lot of earnings presentations I see: growth targets, challenges, and what they want their financial business model to be. This is a good place to start with understanding WD40’s focus and ambitions.

Their presentation comes back to provide the near-term guidance, and then, not least important, appendices that explain how standard, “GAAP*” numbers connect to their adjusted numbers.

*Generally accepted accounting principles. This is the standard most US companies use to report their financials. We will come back to the importance of non-GAAP vs. GAAP, but you can think of adjusted or tweaked numbers as non-GAAP, and the ‘pure’ numbers as GAAP.

Investor presentations

Companies also publish presentations outside of earnings season. They might have an investors’ day, or they might have a standing presentation that represents their investment story. The earnings presentation is usually taking from the standard presentation, and then adding in the latest results.

Delta, for example, had an investor day in June and published a presentation. A presentation outside of earnings will focus more on medium to long-term strategy, as a rule.

What are we getting out of this

Earnings reports are more ephemeral than quarterly or annual reports. They matter more if you already own shares, rather than if you are investigating a new stock. But, often times a stock will show up on our screens or radars because of an earnings report. Finding out what the company’s story is and what happened that raised it to your attention is valuable. The reports and the presentations can help us do this.

The presentations also spoon feed us the company’s narrative. You should not just swallow this down! But knowing what the company is measuring itself against will help you assess the management team and the company as a whole. Does their story change or are they consistent? Do they hit their targets? Do they adjust their outlooks up or down over time?

The presentation and the earnings reports are the best face a management team can put on their business. You can take those one of two ways. Cynically, you can ignore that best face and just take the highlighted information, and then go do your real work elsewhere. Or, you can review a company’s best face, and then if it still doesn’t excite you, you can put it aside and look to your next idea.

Saving time

I’ve been a little sarcastic about management spinning their results, but why wouldn’t they? And why wouldn’t you use that to your advantage? Earnings reports and presentations give you a lot of the information you need, much faster than in the annual or quarterly reports. I still like to go to those reports in the end, to confirm everything and dig deeper.

But as you’re starting to look at a company, these earnings reports and presentations can be huge time savers. They can act as guides to the more detailed reports. And especially once you own a stock, you are going to want to get familiar with them. You just need to know how to use earnings reports and presentations properly, so you don’t swallow down the wrong information.

There’s one more component of the earnings reporting story I’ve only hinted at: earnings call transcripts. We’ll cover that next.

One response to “How to Use Earnings Reports & Presentations for Stock Research”

[…] Let’s discuss how to use earnings call transcripts to elevate your investing research. It is a nice complement to reading the 10-Ks and 10-Qs, and to reviewing earnings reports and presentations. […]