Good artists copy, great artists steal.

Ironically, many famous artists or writers have said something along those lines. Picasso, maybe. William Faulkner, Igor Stravinsky, T.S. Eliot, and most recently, Steve Jobs have all had that line attached to their name.

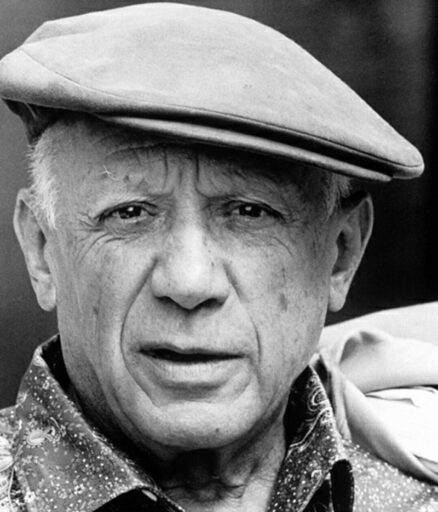

Pablo Picasso never got called a thief…or did he? Source: Wikipedia

It’s relevant not just in art but in the stock market. With millions of investors chasing thousands of stocks, it’s inevitable that someone else will have thought to buy a stock before you did. Which works in your advantage. Here’s how you can find stocks using other people’s ideas.

Why would you take other people’s investing ideas?

Start from your own ideas and find people who also own them. You might then find both investors with similar styles and picks that are similar to your own ideas. This might give you a head start on other stocks to research. If you own company XYZ, you can look up hedge funds who own that stock. Looking at the rest of those funds’ portfolios could be a “pre-screen” for something that is worth your time.

If you’re still figuring out your style, this could be a way to see what’s out there. Many of the ‘other people’ we’re talking about are famous investors. Investing in what they invest in and talk about is a way to learn how they think about investing, by applying it into action. Just like karaoke or playing covers, emulating how the best invest can help you develop your own investing voice.

Even advanced investors can get stuck, where they need a different perspective. One way to getting beyond your usual options is looking at other people’s investing ideas. You extend your potential opportunity set. It can help you get beyond the biggest companies in the world, for example, or help you re-look at a company you might have been aware of but not thinking about as an investment.

The last reason it’s worth taking other people’s investing ideas as starting points for research is that there are a lot of successful investors out there. If someone has a good track record in the market, it’s worth taking their ideas seriously. Especially if they’ve had success in a specific, similar area to the pick in question.

Get our posts and ideas in your inbox!

Why wouldn’t you take other people’s ideas?

Let’s say you look at Warren Buffett’s stock and decide to invest in one of the one’s he owns. Warren Buffett is one of the greatest investors ever. Why wouldn’t you want to listen to him?

First, because if the stock goes down, you can’t blame Warren. You have to do your own work, just as with any stock idea you find. Using someone else’s logic as a starting point is fine, but you own the results. You need to understand why this is a good pick. Buffett won’t pick up the phone to address your complaints.

Another reason to not take someone’s idea is because the buying is the easy part. You make your money in knowing whether to hold on, whether to add, whether to sell. If you don’t understand what you are buying or why, you’re vulnerable and dependent on others. You might not even learn when that source sells the stock. If you do, it will probably be after the fact. And meanwhile, if anything goes wrong with the stock and you don’t understand its story well enough, you’re left waiting on an oracle instead of in control. That’s not a good place to be.

In many cases, when you get an idea from another person, they’re sharing it for a reason. Namely, they want other people to buy the stock in question. This is not necessarily nefarious. But keep in mind that investors are not sharing the stock tip out of the benevolence of their heart.

Which leads me to my last point. There’s a great story in the old baseball book Ball Four. One of the players shouts the right thing to do to a teammate. The teammate ignores him and messes the play up. The author, a player on the other team, yells at the player shouting that, “Goose, he had to consider the source.” Goose gives him grief about this two years later.

It’s true that good ideas can come from anywhere and anyone. It is worth considering the source to see if they genuinely have a track record or insight into a given topic. A good record does not mean blind following, and a bad track record isn’t totally disqualifying. But, if they haven’t got this topic right in the past, or seem out of their depth on a highly technical area, it may be better skipping this idea and looking for another source.

The tl;dr version of this section – no one is infallible, and no one is responsible for your investing except you. Always take other people’s ideas as starting points and no more, and do your own work.

Where can you find other people’s investing ideas?

The most popular and obvious place to get other people’s ideas is in 13F filings. 13F forms are filings that the biggest professional investors in the world have to submit each quarter. The Warren Buffetts, David Einhorns, Carl Icahns of the world all file 45 days after the end of a quarter. On August 15th or 16th you’ll see a bevy of new 13F filings, with updated positions from these professional managers. Any new buys or significant additions in position size are closely followed, and usually move the stocks up.

An important plus to this is that these are not willingly revealed, so this is the case where the manager may not necessarily be sharing the idea to move the stock higher. On the other hand, the information is 45 days old and could be outdated, and lacking of context.

Again, you shouldn’t act on the mere presence of a stock in a professional manager’s portfolio, but it might give you an idea.

Many hedge fund managers and professional investors will write letters once a quarter where they talk about the market – usually not valuable – and about their stocks. Some will include full pitches for a stock or idea. There you can not only get a potential lead to your own portfolio, but a window into how the professional manager thinks about investing. This can be a good learning experience even if you don’t do anything with the idea.

Beyond the professionals, the web is full of places to find investing ideas. Dig around on “fintwit” – financial twitter – and you’ll find many investors who either talk about their investing ideas directly on twitter*, or who link to places where they write more in detail. Seeking Alpha offers a plethora of investing ideas, some of them good even – a subscription costs $240/year. Substack’s financial newsletter ecosystem is pretty strong and much of the content is free. Value Investor’s Club is one of the original idea sites. The ideas are value investing oriented (duh), and can be more advanced or ornate. They’re available for free at a 45 day delay.

*Presuming Twitter survives current ownership.

Again, you should take all of these sites and the ideas found therein with a grain of salt. You don’t know who the investor is, it’s hard to establish a track record or a motive for sharing the idea, and all of the facts and angles should be confirmed with your own research. Still, I’ve found they can be just as good a starting point as a screen or a professional investor’s picks.

Examples

Here are three examples of this approach from my investing.

I saw Louisiana Pacific (LPX) in Berkshire Hathaway’s portfolio last November 2022. The lumber company had been showing up in screens I was running, so this was a second push to consider the stock. In the end, I did my research and didn’t like where it was in the cycle, and never bought the shares. In the meantime, Buffett’s company increased its position by 21% in the following 6 months. LPX stock has risen 6.8% since the news came out (or 15% if you include the pop when it was announced), vs. 8-9% in the S&P 500.

One I bought more recently was Charles Schwab (SCHW). The brokerage’s stock plummeted in the wake of the regional bank crisis of this March, and was the most interesting stock in my view to come out of all of that. But I didn’t totally understand the situation. Then I read a couple interesting pitches in favor of the stock, and did my own research. I became more comfortable with the idea that Charles Schwab is a wonderful company at a, at worst, fair price, per the old Buffett saying. I bought some shares this quarter and will probably buy more.

My best example: Ian Bezek, a writer on Seeking Alpha I knew and respected, made the case for buying a company that ran Mexican airports. I would never have thought of investing in Mexican airport companies – there are three, basically, and he pitched one of them. His case was pretty good. It wasn’t perfect – I remember I got different numbers when I ran all the math – but the thesis was correct. I bought Grupo Aeroportuario del Pacifico (PAC) at the time, and then later Grupo Aeroportuario del Centro Norte (OMAB), and added to them during and after the pandemic bottom, when it became clear travel would recover. I should have bought more, but I’ve made more money in my accounts on them than just about anything else.

Conclusion

We never know everything in the market. And even with the thousands of stocks out there, it can be hard to find one we’re excited about investing in. I think it’s good to listen to how other investors are investing, and when they have a good idea, I’m not shy about researching it for my own portfolio. It’s been one of my best ways to find new investing ideas.

A Short Investing Guide, free by email

The key is, I have to do my own work to feel like I understand the idea, and feel like I’m comfortable taking responsibility for the results, no matter where I get the idea. Bad investors copy and then blame the original when things go wrong; good investors steal and make an idea their own, for better or worse.

Disclosure: I own shares of BRK.B (Berkshire Hathaway), PAC, SCHW, and OMAB. I have no plans to make changes in the coming weeks except perhaps to buy more SCHW shares.

2 responses to “How to Find Stocks Using Other People’s Ideas”

[…] I should note there were a couple articles I found valuable in considering this position, as discussed in this video. […]

[…] the world of stocks to get to the criteria you like. And there’s coattail riding, or following other people’s ideas, as long as you do your own […]