Investor, know thyself

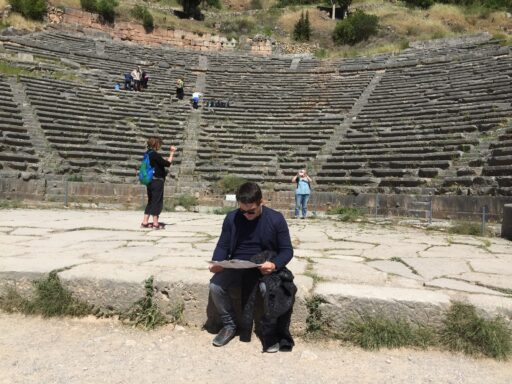

In the hills and mountains, there rise the remains of ancient buildings, stoae and columns, crumbling walls and eroded stadiums. We’re in Delphi. The Ancient Greeks believed it to be the center of the world. The oracle of Delphi became famous, Apollo’s attendants known for telling the future better than anyone else.

We’re not in Delphi for its oracle, though. Instead we’re looking for one of its eternal pieces of wisdom. Inscribed on a column at the entrance to Apollo’s temple is the phrase “Know Thyself.”

It’s an enigmatic phrase, a command to understand yourself before you ask bigger questions. It’s a hard command to follow, for who truly knows oneself? The struggle, as they say, is real.

Sign up for A Short Investing Guide in your email

And it’s a struggle that is vital to being a successful investor. The hardest parts of investing require self-awareness, and an investing style that suits your character, abilities, and interests.

To help you find what your investing style might be, I’m going to talk about three general investing approaches. They’re not mutually exclusive, and you can build your investing style from more than one of these. But this categorization helps understand how others approach stocks and how you might approach stocks. I will exaggerate a little, to help you see which most resonates with you. Then I’ll tell you where I stand among these groups.

Meet the value investor

Ever go hunting in record sales for that one limited edition colored vinyl release, only to find it available for the full price, and decide, actually you want a discount? Are garage sales dangerous because you can’t stop yourself from picking up a bargain? Do you stop liking shows or bands or teams once they get popular? You may have a little value investor in you.

Value investors hunt for bargains, and have been schooled in the wisdom of Buffett and Benjamin Graham. Value investors like to read for hours until they can find an obscure company, or to go against the grain on a popular company that is in the market’s bad books because there is longer term value. They like to rely on the numbers, and on the past, rather than having bold expectations about what’s to come.

If I could paint a value investor’s character, I would say they are a confident skeptic. They think they’re smarter than everyone else, and that human behavior doesn’t change. If there is a classic quote to attribute to them, it would be

There is nothing new under the sun.

Ecclesiastes 1:9

Meet the growth investor

The past has taught the growth investor one thing, and that is that it pays to look ahead to the future. Innovation, change, the cutting edge, early adopters, and hope of a better world, or at least a more exciting place to think about. The growth investor believes in getting in at the ground floor. They have already ordered one if not two Apple Vision Pro headsets to go with their other gadgets.

Unlike the value investor, the growth investor knows that good things cost money. The stock market is driven by the best stocks, so rather than bother digging in the dumpster bins, the growth investor looks for the best companies in the world, and holds onto them. Their quote?

Compound interest is the 8th wonder of the world.

Albert Einstein, supposedly but not really

Even if Einstein didn’t say that, the growth investor believes the point, and then adds that compound growth is even better.

Meet the momentum investor

The momentum investor believes in a lot less than the other two. Their trust is not in themselves but in others – the wisdom of the crowds. If millions of people are buying shares of a company, who is the momentum investor to say they’re wrong? They are happy to jump along for the ride.

The momentum investor’s conviction in their investments comes from the crowd, and from the notion that a line goes up and so it should continue to go up. We might credit the Will Rogers’ quote to the momentum investor:

“The way to make money in the stock market is to buy a stock. Then, when it goes up, sell it. If it’s not going to go up, don’t buy it.”

Will Rogers

Except the momentum investor is doing that in the present tense. A better way to describe it is to go to Isaac Newton’s first law of physics:

An object in motion tends to stay in motion.

Isaac Newton

The momentum investor is often called a trend follower. But this is no insult to them: they know that the trend is your friend, and are happy to take its guidance to higher profits.

Why knowing thyself matters

I share all this for two reasons.

- You will inevitably have hard times in the market. You will make mistakes. Your investing style or the stocks you own will be out of the market’s favor. It will be hard to tell between those conditions.

Given that, you need a strategy that makes sense to you. Mistakes are correctable, but sometimes you just have to ride the hard times out. Believing in what you are doing will get you there.

It’s not that you pick a style or strategy for life. You should evolve as an investor as you learn. But jumping off a horse midstream, just as the current picks up pace and is ready to carry you out to the sea, well, it’s a wet metaphor but I think you can imagine it’s not a great idea. - There’s no right way to invest. No perfect formula, no category that always wins – markets ebb and flow, trends come and go.

If you’re spending extra time on investing actively – instead of indexing – you should enjoy what you’re doing. It’s ok to think of your investing style the way you think of your wardrobe: it should be something that you can fit into, and enjoy putting on. It should make money – if it doesn’t, just go index – and it will be more fun if you do make money. But there are different fits for different folks. And your style can help guide how you look for, find, and evaluate stocks.

My investing

I’ve always gravitated towards cutting against conventional wisdom, and towards getting things cheaply. Value investing has always made the most sense to me.

That said, it’s not black or white. Growth investing has been more or less dominant since I started investing in 2011. As such, I’ve learned to appreciate the importance of finding quality companies. To own them, sometimes I need to pay full price. Other times, I can find them on sale for whatever reason. Warren Buffett has said:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Warren Buffett

I’ve come around to that view, at least somewhat.

Growth and value are two sides of the same coin. Each type of investor aims to buy stocks for less than they’re worth. Value investors base their estimate of ‘worth’ on the past and near-term future, and growth investors base it more on a medium to longer-term future. I don’t have confidence in knowing how the future will be, so I tend towards value. But that is not to naysay growth investors.

And while I can make the momentum investor sound silly, we have to be aware that momentum investing is in all of us. We look at a price chart, and if a stock is going up over time it’s more impressive than if it’s going down. I’ve said that over the long-term stock prices tend to correlate with the fundamentals, so there’s something to looking at the chart. But, if I can use one more famous quote, Ben Folds once sang:

“When money talks, I hate to listen. But lately it’s been screaming in my ear.”

Ben Folds Five, “Emaline”

The market is always shouting in our ear, and it gets hard to avoid the tug of momentum in our own thinking.

Knowing ourselves and our investing styles

I’ve described three investor archetypes. The description is a little simplistic. I also left out some categories of traders and investors – dividend investing especially deserves its own post. These categories are just a concept for you to think about investing.

Get more A Short Investing Guide Posts in your email

As we get into buying stocks, though, I think it will be a useful concept. These are three lenses to look at stocks, companies, and investing. Our course will start from the value investing lens I best understand. We’ll also look at growth stocks, though. And we will not forget the momentum investor, if only to be aware of how much of our analysis is just ‘stock goes up.’

Most of all, we’ll keep ‘know thyself’ in mind, because it will apply to our investing throughout our journey, not just in our investing style.

One response to “Finding Your Investing Style”

[…] you may have no idea where to start. I’ll go into what I look for when buying a stock later. Your investing style will also affect how you screen. But let’s use one set of criteria just to […]